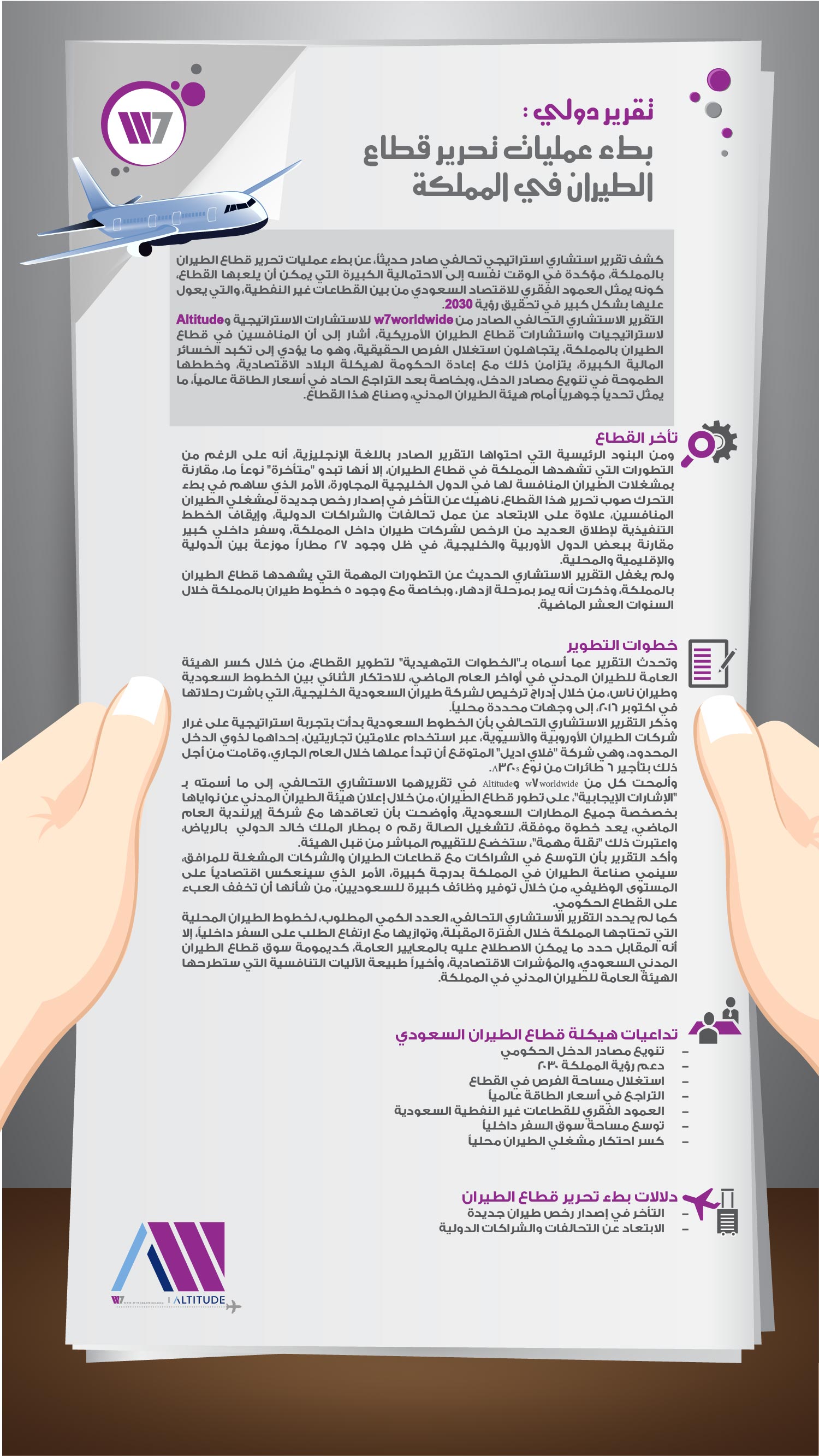

An joint strategic report revealed competitors and those seeking to break into the Saudi aviation industry ignore the opportunities ahead at their own peril. Though recession and austerity still loom large in the country, the economic and domestic political agenda is one of ambitious economic reform. Commercial aviation remains a critical economic backbone, especially in developing the non-oil sectors – a key pillar and goal of the Saudi 2030 Vision

Flag carriers’ exposure to things like currency fluctuations, oil prices, and political change can be felt more acutely by the carrier and the country. In other cases, national carriers benefit from these fluctuations and other perks provided to them.

Saudi Arabia has historically been left out of the big Gulf carriers narrative. Upon a more careful look, this is surprising for a nation that has announced five new airlines in the last ten years and is home to 27 airports, 28 million people, and a limited rail network. In practice though, the slow walk toward liberalization of the sector, licensing delays, and the utter dominance of its flag carrier, Saudi, has deterred international partners and discouraged plans of least one – maybe two – Saudi-focused carriers.

Government Stimulus

We suspect the Gulf aviation narrative might make room for the Kingdom and its growing carriers in the coming years.

Signs of forward momentum have begun to show. In late 2016, the General Authority for Civil Aviation (GACA) broke the duopoly between ever growing LCC Flynas, a private sector airline, and Saudia by granting a license to SaudiGulf, which launched operations shortly thereafter. Saudia, like many flag carriers across Europe and Asia, is experimenting with a dual brand strategy – launching its low-cost carrier, Flyadeal, which is expected to begin operations this year and has leased six A320s.

International Industry

Additionally, GACA has stated its intention to privatize every airport in the country. The first-of-its-kind deal struck with an Irish firm in 2016 to operate Terminal 5 at King Khaled International Airport in Riyadh is a test case foreign partners will be watching closely as more concessions are expected to be made this year. The partnership between Saudi companies and western aerospace and defense manufacturers to expand the Kingdom’s industrial base and create real Saudi jobs is perhaps another vote of confidence for more openness and partnership in an adjacent sector like civil aviation.

The jointly (Altitude and W7) made report did not conclude a quantitative number for the amount of newly created airlines the kingdom needs in the coming few years adjacent, to the demand for domestic flights. However, it did point out the general view of it in terms of the sustainability of the Saudi civil aviation market. Lastly, the report outlined the nature of competitiveness that the General Authority for Civil Aviation (GACA) likely to inflict in the Saudi Market.

Infographic

It is possible to understand the significance of the #Bahrain Government‘s interest in the exhibitions and conferences sector through a tourism strategy based on the development of ports such as King Fahad Bridge, Bahrain International Airport and the Khalifa Bin Salman Port.

imageS

video

W7Worldwide Altitude

Flag carriers’ exposure to things like currency fluctuations, oil prices, and political change can be felt more acutely by the carrier and the country. In other cases, national carriers benefit from these fluctuations and other perks provided to them.